Accelerating the Future of Seafood through Finance

Lighthouse Finance is a global advisory firm that specializes in capital raising, asset finance and management across the seafood value chain. We represent established and early-stage clients across a wide spectrum of industry verticals including fisheries, hatcheries, integrated aquaculture operations, production and processing businesses.

Contact usFinancing the Entire Seafood Value Chain

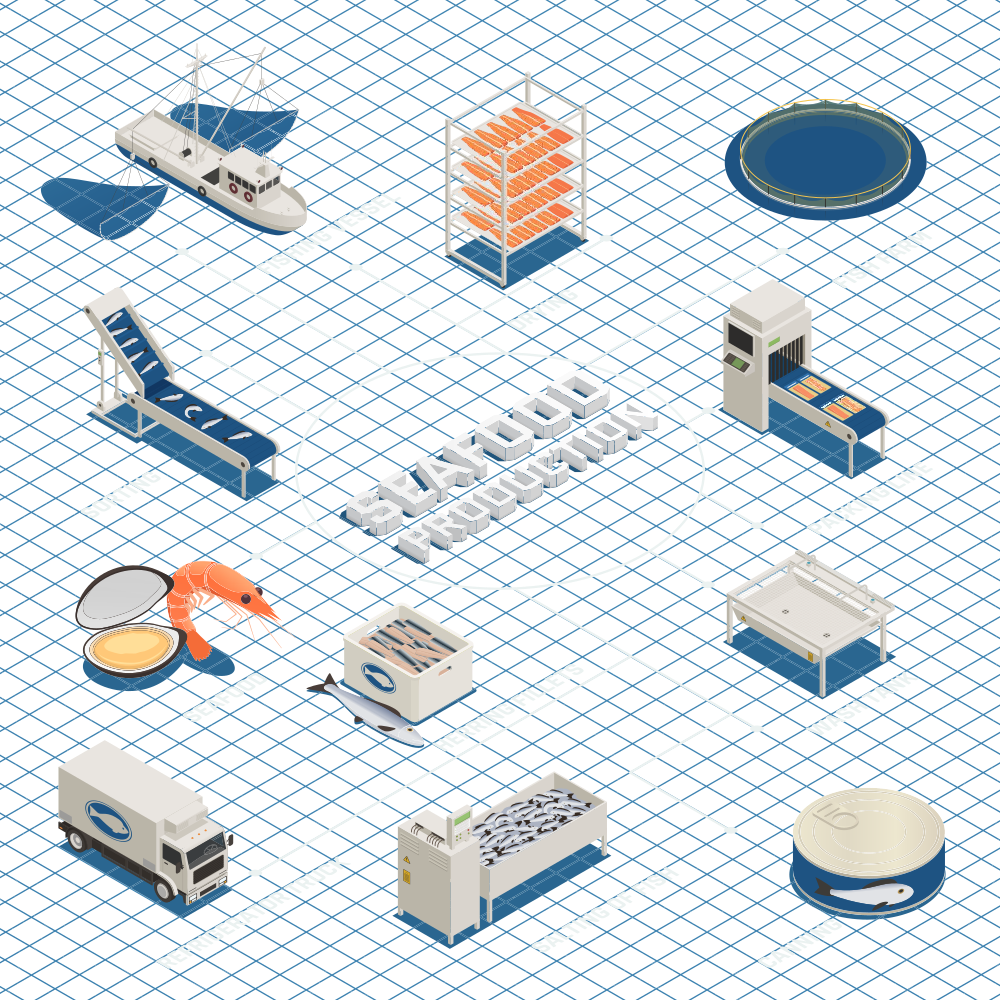

Working alongside our clients and best-in-class manufacturers, Lighthouse has developed in-depth and distinct knowledge of the critical assets that aquaculture and wild catch businesses utilize. From production to processing, our unparalleled understanding of the seafood value chain minimizes investment challenges and execution problems to maximize returns for clients.

Critical seafood assets

Key financing terms

We use our experience and knowledge of the industry to realize the value of your assets and bring you the best financing terms.

80 to 100% LOAN-TO-VALUE (LTV)

5 to 10 YEAR MATURITIES

CONSTRUCTION FINANCING ON MOST ASSETS

SALE-LEASEBACKS TO MONETIZE ASSETS

TAX EFFICIENT LEASING PROGRAMS

OFF-BALANCE SHEET FINANCING

ATTRACTIVE FIXED AND VARIABLE STRUCTURES

PAYMENT SCHEDULES MATCHING CASH FLOWS

Projects

900+ Million USD In financing provided to dateIndustry Expertise

Over the next decade, the seafood industry is poised for unprecedented growth, propelled by an increasing population and higher levels of fish and seafood consumption around the world. However, growth potential remains constrained by:

- Complex operating structures, often across multiple jurisdictions and each with unique legal and regulatory challenges.

- Tighter banking financial regulations and stricter lending mandates.

- Significant upfront capital expenditure required to establish new operations or replenish existing assets.

Lighthouse is expert at developing innovative financing solutions to tackle these challenges. Our team brings together decades of capital markets, seafood industry, and asset finance expertise to create financing solutions to complement your vision for growth and fully realize the intrinsic value of your company.

We draw upon a diverse network of lending and equity partners, industry experts, and manufacturers to navigate the complex investing issues in the global seafood space. Above all, we prioritize you, the client, to ensure that our capital solutions best suit your unique financing needs.

Values

CLIENT DRIVEN

We are committed to delivering best-in-class solutions for all of our clients.

TEAMWORK

We foster ego-free collaboration within our team and seek to work with like-minded peers.

INTEGRITY

We hold ourselves to a high moral standard, insisting on full transparency

GRIT

We. Do not. Quit.

ENJOY THE RIDE

We take delight in our work and remember to have fun.

What We Do

GLOBAL CAPITAL EXPENDITURE PROGRAMS

Leading integrated aquaculture companies and fisheries work with Lighthouse to finance significant asset purchases including vessels, feed barges, processing equipment, net pens, and recirculating aquaculture systems. Our structured finance programs are tailored to be global in scope and, if needed, off-balance sheet to maximize client tax benefits and cash flows on each asset. We work as an extension of your team, managing the entire process and providing legal, financial, and regulatory guidance throughout maturity.

CONSTRUCTION/PROJECT FINANCE

The Lighthouse team structures transactions and raises money to finance the construction of new land-based commercial-sized fish farms, integrated aquaculture systems, and large scale fishing and logistics vessels. We have financed projects for established and early-stage seafood companies throughout North America, Europe, and Asia.

CREDIT GUARANTEE PROGRAMS

Lighthouse has deep relationships and knowledge of credit guarantee programs in key aquaculture-oriented countries around the world. We have worked with GIEK, the Norwegian export credit program, EKF, the Danish export credit program, Export Development Canada, and Ashra, the Israeli export credit program.

CLIENT DRIVEN CAPITAL SOLUTIONS

Client needs and projects are diverse; when it comes to financing, one size does not fit all. We work closely with the business to understand its farming or harvesting models and to develop unique capital solutions to meet their exacting requirements. Our extensive relationship network of commercial banks, family offices, hedge funds, insurance companies, private and institutional investors ensures that you get the right financial partner at the lowest possible cost.

Our Story

Lighthouse was founded in 2013 through a management-led buyout of CMA Asset Management AS, a structured asset finance manager serving the Pan-Nordic region since 1973. Lighthouse quickly became a player in the European seafood finance community and expanded to operations in Norway (Oslo, Trondheim), Denmark (Copenhagen), and Sweden (Stockholm).

In 2017, Lighthouse further extended its global presence by entering into a strategic partnership with Simpler Funding, a U.S.-based advisory firm specializing in comprehensive debt solutions for the middle market. The partnership paired a highly experienced asset finance company with a capital raising team that has deep relationships across a diverse set of institutional investors, family offices, and commercial banks.

In 2018, following stellar results of the initial tie-up, Lighthouse and Simpler Funding officially consolidated into Lighthouse Finance, adding a North American presence in New York City and Chicago.

Leadership

ROY HØIÅS

CHIEF EXECUTIVE OFFICER

ROY HØIÅS

CHIEF EXECUTIVE OFFICER

Founder of Lighthouse Finance. Roy focuses on relationship development and deal origination among global seafood companies, relying on decades of experience to craft financing solutions that meet a client’s exacting needs.

AAGE RASMUSSEN

MANAGING DIRECTOR DENMARK

AAGE RASMUSSEN

MANAGING DIRECTOR DENMARK

Aage uses his local knowledge and expertise of the Danish markets to develop relationships across cutting edge Danish seafood companies, designing financing solutions that accelerate growth.

HEGE BJERKE TOLLEFSEN

OFFICE MANAGER

HEGE BJERKE TOLLEFSEN

OFFICE MANAGER

Hege manages Lighthouse’s existing client contracts and coordinates payment across a complex and diverse web of manufacturers, vendors, lenders, and investors. Her responsibility is to make funding and payment structure seamless for the client.

RAHUL KULKARNI

MANAGING DIRECTOR INDIA

RAHUL KULKARNI

MANAGING DIRECTOR INDIA

Rahul manages the India office primarily focusing on business growth in Asia & Middle-east, employing his two decades plus hands-on experience across all stages of the aquaculture value-chain and network that spans across the global markets.